Weber County Property Information

New for 2026

New for 2026 - Inconsequential Personal Property Exemption (59-2-1115): the taxable tangible personal property of a taxpayer is exempt from taxation if the taxable tangible personal property has a total aggregate fair market value per county of $30,100 or less for 2026.

https://www.webercountyutah.gov/Assessor/ppnew.php

Weber County Treasurer - Property Tax

PROPERTY TAX AND TAXING ENTITIES EXPLAINED How Is Property Tax Calculated? WHERE DO YOUR TAX DOLLARS GO? There are over 90 taxing entities in Weber County. Examples of taxing entities are counties, cities, school districts, and special districts. The services you receive and the taxing entities you pay depend on where you live.

https://www.webercountyutah.gov/Treasurer/property-tax.php

Weber County

Using the menus on your right, you will find answers to frequently asked questions, a calendar of important tax dates in Weber County, telephone numbers for local taxing entities, and links to other county sites. We hope that the information you find here will be both interesting & informative. We welcome your questions and comments!

http://www.co.weber.ut.us/treasurer/

Utah Weber County Parcels

84401, Private, 1-801-399-8441, 1/19/2026, 4:00 PM, 1/19/2026, 4:00 PM, 1/19/2026, 4:00 PM, 2026, Supplied by county as latest, http://www3.co.weber.ut.us/ ...

https://hub.arcgis.com/maps/utah::utah-weber-county-parcelsPersonal Property Online Filing

Quick Tips for Filing Online NEW FOR 2026 We are excited to announce a brand new look for the 2026 Business Personal Property Tax online filing system. This comes with innovative features like linking business accounts under a single user account, enhanced login security, and live viewing of accounts.

https://www.webercountyutah.gov/Assessor/ppfile_instructions.php

Weber County Property Taxes: How They Work & How to Appeal Your Valuation

🏠 Understanding Property Taxes in Weber County 1. Market Value & Assessed Value Every July, property owners receive a Notice of Property Valuation and Tax Changes. This breaks down into: - Market Value: Estimated resale value as of Jan 1 (e.g., 2025).

https://rangerealtyco.com/blog/understanding-property-taxes-in-weber-countyWeber Fire District proposing 23.6% tax hike

The proposed tax increase, if approved, would bolster that by $275,000 in 2026. A recent compensation study showed that Weber County dispatchers ...

https://www.ksl.com/article/51402320/weber-fire-district-proposing-236-tax-hike-weber-county-dispatch-center-mulling-49-bumpHome Page - BOE Appeal

Weber County Board of Equalization 2026 Online Appeal Application Please read all of the instructions and gather all the needed documents before beginning the application process. - Do not complete this application on a mobile device. Use a desktop or laptop for best results.

https://weberapps.co.weber.ut.us/tax/boe

UGRC - Utah Parcels

Utah Parcels Last update · January 2026 - Davis, Grand, Iron, Utah, Wasatch, Washington, Weber The SGID contains parcel boundaries for each of the 29 counties in Utah and is updated as new data is provided from the data steward in each county.

https://gis.utah.gov/products/sgid/cadastre/parcels/

Pony Pride the Horsepower of ISD 834 Local governments must set their preliminary maximum property tax levies for 2026 by the end of September Facebook

What You Need to Know - September 30th, 2025 School Board Meeting Summary 1) Gifted and Talented Update The district is continuing to review opportunities to strengthen gifted and talented services across all schools. Areas of focus include improving student identification, strengthening cluster programming in our schools, supporting the stand-alone GATE 4/5 program, better addressing students’ social and emotional needs, and ensuring rigor at...

https://www.facebook.com/groups/pphp834/posts/1905614570389356/

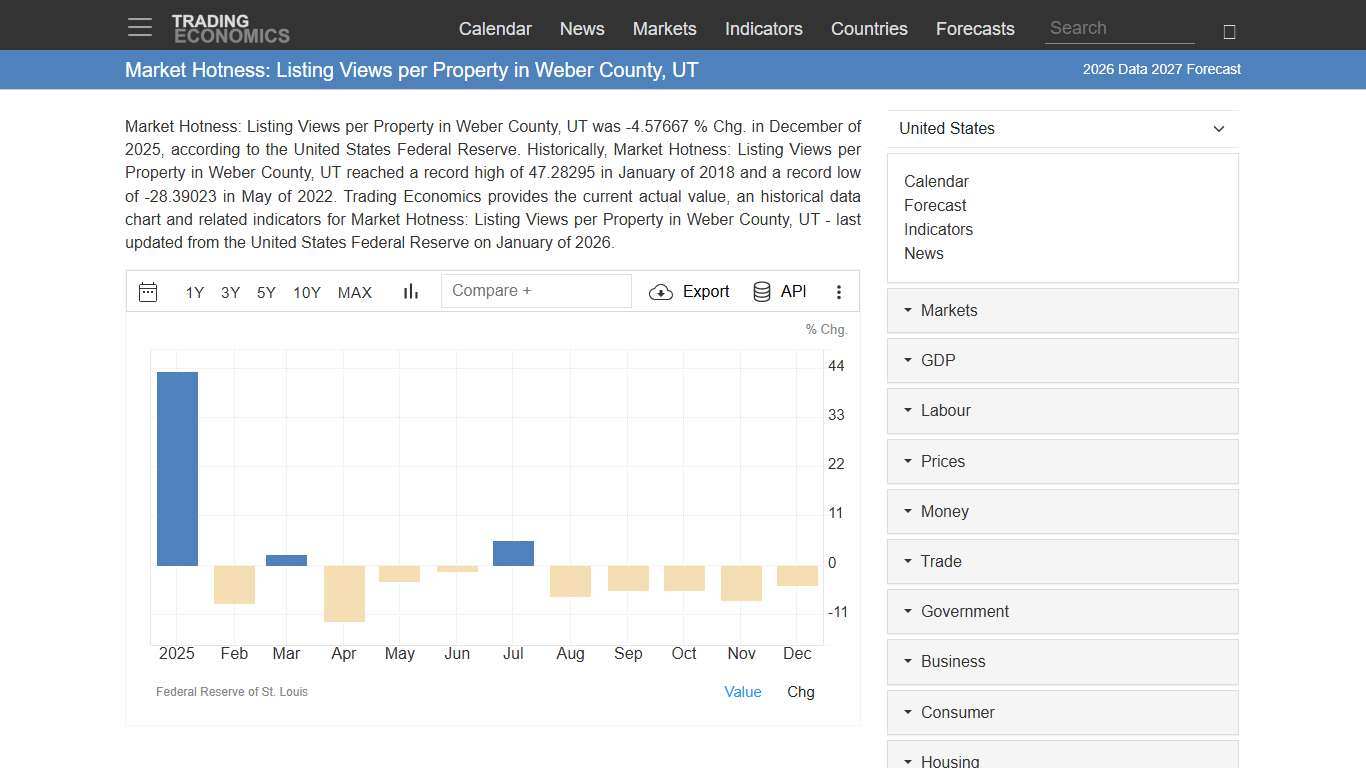

Market Hotness: Listing Views per Property in Weber County, UT - 2026 Data 2027 Forecast

Market Hotness: Listing Views per Property in Weber County, UT was -4.57667 % Chg. in December of 2025, according to the United States Federal Reserve. Historically, Market Hotness: Listing Views per Property in Weber County, UT reached a record high of 47.28295 in January of 2018 and a record low of -28.39023 in May of 2022.

https://tradingeconomics.com/united-states/market-hotness-listing-views-per-property-in-weber-county-ut-fed-data.html

How to Appeal Weber County Property Taxes - Mountain Luxury

In Weber County, 70-percent of assessment appeals are successful. Here’s what you need to know. For many homeowners, the day the county property assessment arrives in the mail is a day of reckoning. It’s nice to see that your property investment is going up in value, but if the assessment comes in too high, the new tax bill can be painful.

https://www.mountainluxury.com/blog/how-to-appeal-your-tax-assessment/

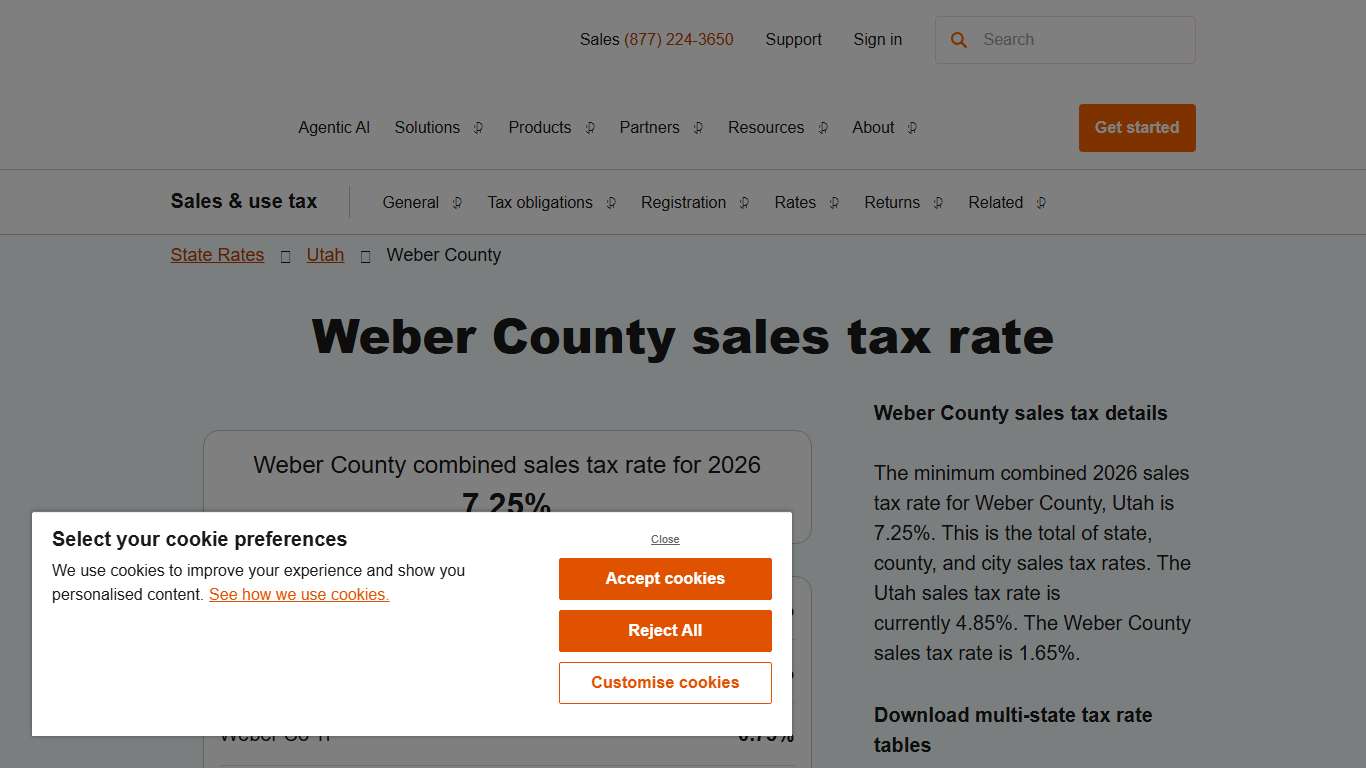

2026 Weber County Sales Tax Rate - Avalara

Weber County sales tax details The minimum combined 2026 sales tax rate for Weber County, Utah is 7.25%. This is the total of state, county, and city sales tax rates. The Utah sales tax rate is currently 4.85%. The Weber County sales tax rate is 1.65%.

https://www.avalara.com/taxrates/en/state-rates/utah/counties/weber-county.html

Ogden, Utah Sales Tax 2026 Guide: Rates & Filing Tips

Ogden Sales Tax Guide 2026 (Utah) Ogden Navigating sales tax compliance in Ogden, Texas can be a challenge for businesses of all sizes. Understanding the local regulations, tax rates, and filing requirements is critical to staying compliant and avoiding penalties. At Kintsugi, we simplify sales tax compliance for businesses, helping you focus on growth without the headache of managing complex tax rules.

https://trykintsugi.com/sales-tax-guide/ogden-utah-sales-tax-guide